Assessed Value of Real Property……….$3500

Assessed Income…………………………...$........

Total Assessment…………………….……..$3500

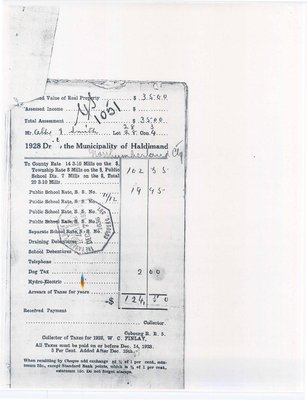

Mr. Albert Smith…………….Lot 28/28…….Con3/4

| To County Rate 14 3-10 Mills on the $, Township Rate 8 Mills on the $; Public School Dis. 7 Mills on the $, Total 29 3-10 Mills. | 102 | 35 |

| Public School Rate, S.S. No. | 19 | 95 |

| Public School Rate, S.S. No. 11/12 | ||

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. | ||

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax | ||

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $124. | 50 |

Received Payment

……………………………………………………….Collector.

| Cobourg R.R.5. |

All Taxes must be paid on or before Dec. 14, 1928.

5 Per Cent. Added After Dec. 15th.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Standard Bank points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Assessed Value of Real Property……….$3500

Assessed Income…………………………....$........

Total Assessment……………………….…...$3500

Mr. Albert Smith…………..Lot 28/28..Con3/4

| To County Rate 17.5 Mills on the $, Township Rate 9 Mills on the $; Distribution of School Rate 7.5 Mills. Total, 34 Mills. | 119 | 00 |

| Public School Rate, S.S. No. 11/12 | 24 | 50 |

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. | ||

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax | ||

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $143. | 50 |

Received Payment

………W.C. Finlay……….Collector.

| Cobourg R.R.5. |

All Taxes must be paid on or before Dec. 13, 1930.

5 Per Cent. Added After Dec. 15th.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

If paid to the Bank they will charge as follows:

5 Cents on Individual Accounts Under $15.00

10 Cents on Individual Accounts of $15.00 and Over.

Assessed Value of Real Property……….$3500

Assessed Income…………….…………….$........

Total Assessment…………………………...$........

Mr. Albert Smith…………..Lot 28..Con3/4

| To County Rate 12.8 Mills on the $, Township Rate 9 Mills on the $; Distribution of School Rate 7.2 Mills. Total, 29 Mills. | 101 | 50 |

| Public School Rate, S.S. No. | 12 | 60 |

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. | ||

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax | 2 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $116 | 10 |

Received Payment

………………………..……….Collector.

| Grafton |

All Taxes must be paid on or before Dec. 14, 1932.

5 Per Cent. Added After Dec. 15th.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

If paid to the Bank they will charge as follows:

5 Cents on Individual Accounts Under $15.00

10 Cents on Individual Accounts of $15.00 and Over.

Assessed Value of Real Property…3500…$123.00

Business Assessment…………………………$........

Total Assessment……………………………..

Mr. Albert Smith…………..Lot 28/28..Con3/4

| To County Rate 13 Mills on the $, Township Rate 8.3 Mills on the $; Distribution of School Rate 7.7 Mills. Total 29 Mills. | 101 | 50 |

| Public School Rate, S.S. No. 11 | ||

| Public School Rate, S.S. No. 12 | 17 | 50 |

| ………………………………... | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax…..2 | 4 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| ………………………………... | ||

| $123. | 00 |

| Burnley |

2% Penalty added after Dec. 14th., 1941

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg, Colborne and Grafton Branches of the Canadian Bank of Commerce.

1/2 of 1 per cent per month added after January 1st, 1942.

No. on Roll………………..Lot.28………Con.3, 4

Assessed Value of Real Property……..…$......

Business Assessment…………………….$........

Total Assessment…………………………$3500

Mr. Albert Smith…………..

| To County Rate Schools 3.7 Mills County Rate 13.3 Mils on the $... Twp. Roads 20 Mills on the $... Township Rate 5.3 Mills on the $ Distribution of School Rate 7.7 Mills. Total 50 Mills. | 175 | 00 |

| Public School Rate, S.S. No….. | 31 | 50 |

| Telephone | ||

| Hydro | ||

| Dog Tax….. | ||

| Arrears of Taxes for years | ||

| ………………………………... | ||

| $206 | 50 |

Penalty of ½ of 1% added after

Dec.1st., 1949

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg and Colborne Branches of the Canadian Bank of Commerce and Roseneath Branch of the Royal Bank of Canada if paid by December 1st, 1949.

Interest 1/2 of 1 per cent per month charged after January 1st, 1950.

Make all cheques payable to Township of Haldimand, Grafton, Ont.

Assessed Value of Real Property…3500…$124.50

Assessed Income………………………………$........

Total Assessment………………………………$…...

Mr. Albert Smith…………..Lot 28/28..Con3/4

| To County Rate 14 Mills on the $, Township Rate 9 Mills on the $; Distribution of School Rate 7 Mills. Total 30 Mills. | 101 | 50 |

| Public School Rate, S.S. No. 11 | ||

| Public School Rate, S.S. No. 12 | 21 | 00 |

| Separate School Rate, S.S. No…. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax…..1 | 2 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $124 | 50 |

Received Payment

……..H.E. Minor…..Collector

| Burnley |

3% added after Dec. 15th., 1938

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg, Colborne, Castleton and Grafton Branches of the Canadian Bank of Commerce.

1/2 of 1 per cent per month added after January 1st, 1939.

Assessed Value of Real Property…..3500…$103.85

Assessed Income……………………………….$........

Total Assessment………………………….…....$........

Mr. Albert Smith…………………......Lot............Con…..

| To County Rate 13.2 Mills on the $, Township Rate 6.2 Mills on the $; Distribution of School Rate 5.6 Mills. Total 25 Mills. | 87 | 50 |

| Public School Rate, S.S. No. 11 | 12 | 60 |

| Public School Rate, S.S. No. 12 | 14 | 35 |

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax | 2 | |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $103 | 85 |

Received Payment

………………………..……….Collector.

| Burnley |

3% added after Dec. 15th, 1935.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg, Colborne, Castleton and Grafton Branches of the Canadian Bank of Commerce

Assessed Value of Real Property……3500…$95.10

Assessed Income……………………………..….$........

Total Assessment………………………………...$........

Mr. Smith Albert…………..Lot 28..Con3

| To County Rate 12.6 Mills on the $, Township Rate 6.8 Mills on the $; Distribution of School Rate 5.6 Mills. Total 25 Mills. | 87 | 50 |

| Public School Rate, S.S. No. 11012 | 5 | 60 |

| Public School Rate, S.S. No. | ||

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax…..1 | 2 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $95 | 10 |

Received Payment

………….H.E. Minor….Collector.

| Burnley |

5% added after Dec. 15th., 1934.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg, Colborne, Castleton and Grafton Branches of the Canadian Bank of Commerce. before Dec. 15

Assessed Value of Real Property…..$3500…..

Amount $...............119.25………….Page 38........

Mr. A. Smith……Lot 28…Con 3…No.43....

Mr…….………….Lot.28..Con 4….No. 15 [1936].

| Distribution of School Rate 6.2 Mills. Total 29 Mills. | 101 | 50 |

| Public School Rate, S.S. No. 11 | 15 | 75 |

| Public School Rate, S.S. No. 12 | 14 | 35 |

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax…..1 | 2 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| May 27, 1937. 40.60. C.S. Rutherford. | $119 | 25 |

Received Payment in full

C.S. Rutherford, May 27th, 1937…….Collector.

| Burnley |

3% added after Dec. 15th, 1936.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg, Colborne, Castleton and Grafton Branches of the Canadian Bank of Commerce

Assessed Value of Real Property….3500…$121.00

Assessed Income………………………….…...$........

Total Assessment………………………………$....... Mr. Albert Smith….Lot.28/28..Con 3/4….

| To County Rate 14 Mills on the $, Township Rate 9.5 Mills on the $; Distribution of School Rate 6.5 Mills. Total 30 Mills. | 101 | 50 |

| Public School Rate, S.S. No. 11 | 17 | 50 |

| Public School Rate, S.S. No. 12 | 14 | 35 |

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax…..1 | 2 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $121 | 00 |

Received Payment

H.E. Minor…….Collector.

| Burnley |

3% added after Dec. 15th, 1937.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg, Colborne, Castleton and Grafton Branches of the Canadian Bank of Commerce

1/2 of 1 per cent per month added after January 1st., 1938.

Assessed Value of Real Property……….$3500

Assessed Income…………………………..$........

Total Assessment……….…………………..$........

Mr. Albert Smith…………..Lot 28..Con3/4

| To County Rate 12.4 Mills on the $, Township Rate 7 Mills on the $; Distribution of School Rate 5.6 Mills. Total 25 Mills. | 87 | 50 |

| Public School Rate, S.S. No. | 15 | 75 |

| Public School Rate, S.S. No. | ||

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax | 2 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $105 | 25 | |

| $5 | 26 | |

| Received Payment | $99 | 99 |

………………………..……….Collector.

| Grafton |

A discount of 5% on all 1933 taxes paid on or before Dec. 15, 1933; and 5% added after Dec. 15th., 1933.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

5 Cents on Individual Accounts Under $15.00

10 Cents on Individual Accounts of $15.00 and Over.

No. on Roll…410..…………..Lot.28………...Con.3-4

Assessed Value of Real Property……..…$......

Business Assessment…………………….$........

Total Assessment…………………………$3500

Mr. Albert Smith…………………………………..

| To County Rate Schools 3.3Mills County Rate 12.7 Mils on the $... Twp. Roads 12 Mills on the $... Township Rate 4.2 Mills on the $ Distribution of School Rate 7.8 Mills. Total 40 Mills. | 140 | 00 |

| Public School Rate, S.S. No….. | 26 | 25 |

| Telephone | ||

| Hydro | ||

| Dog Tax….. | ||

| Arrears of Taxes for years | ||

| ………………………………... | ||

| $166 | 25 |

The General Tax Rate has been reduced by one mill by reason of the Provincial Subsidy to Municipalities and the rates levied for school purposes have been reduced by an amount equal in total to $20,935.54 received by the respective School Boards from the Provincial Government towards educational costs to be used for the relief of taxation on real estate.

Penalty of ½ of 1% added after Dec.1st., 1947

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg and Colborne Branches of the Canadian Bank of Commerce and Roseneath Branch of the Royal Bank of Canada if paid by December 1st, 1949.

Interest 1/2 of 1 per cent per month charged after January 1st, 1948.

Make all cheques payable to Township of Haldimand.

Cobourg, Ont., Dec 4, 1941

Mr. A.E. Smith

Baltimore

In Account With

To your Post Paid $10.00

P. Delanty Sons

Jack Delanty

Assessed Value of Real Property……….$3800

Assessed Income…………………………$3800

Total Assessment………………………..$3500

Mr. Smith Albert…………………….….Lot 28…Con…4

Northumberland Cty.

| To County Rate 12 Mills on the $, Township Rate 8 Mills on the $; Public School Dis. 6 8-10 Mills on the $, Total 26 8-10 3-10 Mills. | 101 | 84 |

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. 11-12 | 20 | 90 |

| Separate School Rate, S.S. No. | ||

| Draining Debentures | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax | 2 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| $124. | 44 |

Received Payment

……………………………………………………….Collector.

| Cobourg R.R.5. |

All Taxes must be paid on or before Dec. 14, 1927.

5 Per Cent. Added After Dec. 15th.

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Standard Bank points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Assessed Value of Real Property…3500…$12.05

Assessed Income……………………………....$........

Total Assessment……………………………..

Mr. Albert Smith…………..Lot 28/28..Con3/4

| To County Rate 13 Mills on the $, Township Rate 8.2 Mills on the $; Distribution of School Rate 7.8 Mills. Total 29 Mills. | 101 | 50 |

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. | ||

| Public School Rate, S.S. No. 11+12 | 18 | 55 |

| ………………………………... | ||

| School Debentures | ||

| Telephone | ||

| Dog Tax | 2 | 00 |

| Hydro-Electric | ||

| Arrears of Taxes for years | ||

| ………………………………... | ||

| $122. | 05 |

| Burnley |

2% Penalty added after Dec. 15th., 1942

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg, Colborne and Grafton Branches of the Canadian Bank of Commerce.

1/2 of 1 per cent per month added after January 1st, 1943.

Total Assessment…………………………

Mr. A Smith…………..

| To County Rate 12.8 Mills Twp. Roads 12 Mills on the $... Township Rate 3.4 Mills on the $ Distribution of School Rate 7.8 Mills. Total 36 Mills. | 108 | 00 |

| Public School Rate, S.S. No. 11 | 16 | 50 |

| Township Area | ||

| Telephone | ||

| Dog Tax | 2 | 00 |

| Hydro Electric | ||

| Arrears of Taxes for years | ||

| ………………………………... | ||

| $126 | 50 |

The General Tax Rate has been reduced by one mill by reason of the Provincial Subsidy to Municipalities and the rates levied for school purposes have been reduced by an amount equal in total to $20,935.54 received by the respective School Boards from the Provincial Government towards educational costs to be used for the relief of taxation on real estate.

Penalty of 3% added after Dec.14th., 1946

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg and Colborne Branches of the Canadian Bank of Commerce and Roseneath Branch of the Royal Bank of Canada if paid by December 1st, 1949.

Interest 1/2 of 1 per cent per month charged after January 1st, 1947.

Make all cheques payable to Township of Haldimand.

Mr. A Smith…………..

| To County Rate 12.8 Mills Twp. Roads 12 Mills on the $... Township Rate 3.4 Mills on the $ Distribution of School Rate 7.8 Mills. Total 36 Mills. | 126 | 00 |

| Public School Rate, S.S. No. 11 | 19 | 25 |

| Township Area | ||

| Telephone | ||

| Dog Tax | 2 | 00 |

| Hydro Electric | ||

| Arrears of Taxes for years | ||

| ………………………………... | ||

| $147 | 25 |

The General Tax Rate has been reduced by one mill by reason of the Provincial Subsidy to Municipalities and the rates levied for school purposes have been reduced by an amount equal in total to $20,935.54 received by the respective School Boards from the Provincial Government towards educational costs to be used for the relief of taxation on real estate.

Penalty of 3% added after Dec.14th., 1946

When remitting by Cheque add exchange at ¼ of 1 per cent., minimum 25c, except Canadian Bank of Commerce points ,which is 1/8 of 1 per cent., minimum 15c. Do not forget stamps.

Payable at par at Cobourg and Colborne Branches of the Canadian Bank of Commerce and Roseneath Branch of the Royal Bank of Canada if paid by December 1st, 1949.

Interest 1/2 of 1 per cent per month charged after January 1st, 1947.

Make all cheques payable to Township of Haldimand.